Pension freedoms brought fundamental change to retirement planning and the way your clients can take money from their pension.

The subsequent rise in drawdown, and the much-welcomed increase in choice and flexibility came with additional risks. Heightened exposure to sequencing and longevity risk, and the steady decline of defined benefit pensions, should have led to a shift in retirement planning strategies. To find out, the FCA launched its thematic review of retirement income advice in 2019. Paused due to the pandemic, it has now been published and you can read the findings here.

The direction of travel from the regulator is clear. Firms will have to reassess existing retirement investment and income strategies to ensure they are fit for purpose. Advice models that are not suitably designed to meet the specific needs of clients in decumulation will come under scrutiny.

A new phase of retirement planning is on the horizon. That’s why we’ve pooled together the resources from our teams at Wealthtime and Copia, and experts from across the industry to provide insight to help advisers assess their current retirement strategies, and plan for the future.

This content is intended for professional advisers only.

Webinar - How to build and maintain a best-in-class retirement service

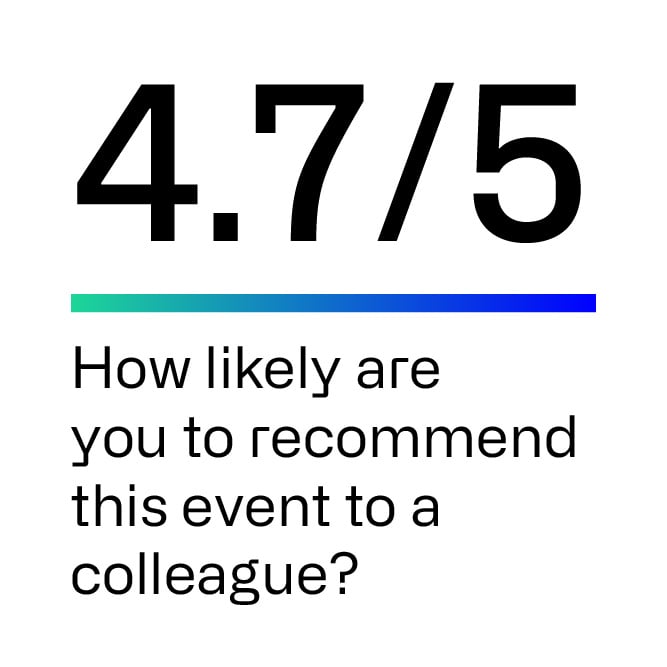

When we hosted our first round of Rethinking Retirement Roadshows back in April 2024, nearly three quarters of attendees told us they were actively reviewing their retirement strategy.

Six months later, we sent our experts back on the road. This time the objective was to help advisers move from reviewing and strategising to implementing and executing a best-in-class retirement advice service.

The feedback from the events has been brilliant, so we’ve put it in a webinar for anyone who missed it. Take a look at what's on the agenda and watch it today.

Navigating retirement: critical decisions on platforms and investments

Our experts will be teaming up to highlight what advisers need from their platform of choice when supporting clients in retirement, and why purpose-built decumulation portfolios are more important than ever.

Alternative ways to address sequencing and longevity risk

Our friends from Just are back. This time they’ll be talking about some of decumulation’s biggest risk factors and some alternative ways of managing them.

Must-have tools for executing your CRP

Mabel Insights know all about executing CRPs and they’ll be joining us to discuss the practical tools you need for investment due diligence, client risk assessments, cashflow planning and more…

Essential DIY plan for building and benchmarking a CRP

Conduct Culture will cover the steps required to build a new CRP or benchmark an existing one in line with your business needs and the regulator’s expectations.

Latest retirement articles

Navigating the transition to retirement - now is the time to change gear

Read More >

The future of decumulation advice

Read More >

Rethinking retirement – the importance of flexibility in retirement planning

Read More >

Advisers need to consider different approaches to retirement income in light of FCA review

Read More >

Decumulation: How blending investments and annuities can work

Read More >

Using pensions for legacy planning

Read More >

A different approach when it comes to decumulation?

Read More >

Innovating investment for retirement income

Read More >

Rethinking Retirement: Changing Gear

Conducted in partnership with the lang cat, the findings are based on the survey responses from 160 advice professionals. 93% of respondents are employed by or own an independent advice firm.

Get invaluable insights on:

- The implications of the FCA’s thematic review

- CIPs vs. CRPs

- How retirement planning strategies are changing

- What criteria is key to other advisers when selecting their platform of choice

- The re-emerging role of guaranteed income for clients decumulation

Please note this report is intended for professional advisers only.

As retirement planning enters its most substantial new phase since pension freedoms, get ready by reading our new guide.

Based on our recent Rethinking Retirement roadshows - download it now to get invaluable insights on:- Due diligence tips for assessing platforms and your Centralised Retirement Proposition (CRP)

- The implications of the FCA’s Thematic Review

- Platform essentials for retirement planning today

- What a modern approach to secure income looks like

- Actual purpose built decumulation portfolio solutions.

Copia’s Retirement Income (RI) portfolios provide a purpose-build decumulation portfolio strategy that addresses the different needs and risks facing clients in retirement.

Download info sheet >

Copia’s Retirement Income Plus (RI+) offers a fully-blended decumulation portfolio and guaranteed income solution.

Download info sheet >

Just’s Secure Lifetime Income (SLI) allows you to incorporate an element of guaranteed income into your client’s drawdown plan.

Download Just's technical guide >

ses from 160 advice professionals. 160 advice professionals.

Wealthtime and Copia Capital Management are trading names of Novia Financial PLC. Novia Financial plc is a limited company registered in England & Wales. No. 06467886. Registered office: Cambridge House, Henry St, Bath, BA1 1JS. Novia Financial plc is authorised and regulated by the Financial Conduct Authority. FCA Number 481600.